Pay mortgage twice a month calculator

Amazon is hiking Prime prices this week with standard pay-monthly costs rising by 1 a month from 15 September and annual costs increasing by 16 a year. Choose a longer-term mortgage like a 30-year rather than a 15-year loan.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Staying at the previous example it means that you pay 100 dollars 26 times in a year which equals an extra 200 dollars in a year.

. Next origination points are fees you pay to your borrower to assess and process your mortgage. One popular way that some homeowners other borrowers pay down their principal more quickly is to make biweekly payments. There are 26 bi-weekly periods in the year but making only two payments a month would result in 24 payments.

Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows. You can pay off your mortgage early without worrying about expensive extra costs. Use this free online calculator to see how much you will need to pay each month to pay your loan off in a set amount of time.

The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. Discount points are ideal if you have cash on-hand to pay for the points and if you intend to stay long-term in a house. This means an extra payment is not made.

Taking a reverse mortgage drains away equity from your home. Put 20 down or as much as you can for your down payment. By contrast 23 of buy now pay later users make zero payments in an average month 19 make one and 23 make two.

Or whenever you get a bonus or tax refund you could put it toward your mortgage to lower your principal balance. Heirs must pay the reverse mortgage to keep the home. While 20 percent is thought of as the standard down.

Most private student loan companies offer five- seven- 10- and 15-year terms but some also provide 20- or even 25-year terms. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. Meanwhile theres a wide range of monthly payments consumers are taking on.

This payment should be no more than 25 of your monthly take-home pay. When you come to this page youll find the calculator preloaded with a 260386 loanmortgage and 200 a month is the default prepayment amount. By paying 1000 twice a month or 24 times per year you would make a total of 24000 in payments the same as you would if you paid monthly.

For the investment rate-of-return the calculator uses as a default 72 which is the approximate average rate-of-return for the SP 500 according to this somewhat dated analysis. For instance if youre planning to remortgage into a 5 fixed-rate loan it. Bi-weekly is not the same as twice a month.

The exact plan you choose will depend on the. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments. To determine how much property tax you pay each month lenders.

You can also pay your mortgage every 2 weeks as opposed to once a month which will help you pay off an extra month every year. The concept of a twice-monthly payment is a bit misleading. Paying Taxes With a Mortgage.

First-time home buyer How to use this mortgage calculator. This calculator helps you determine the gross paycheck needed to provide a required net amount. How Bi-Weekly Payments Work.

Lenders often roll property taxes into borrowers monthly mortgage bills. If their assets cannot cover the mortgage they will be forced to move out of the home. Using our mortgage rate calculator with PMI taxes and insurance.

Which is not in a leap year you will have at least twice a year three payments in a month. Also consider rounding up your payments to pay your mortgage faster. Improve your credit score.

Other Ways to Save Money on Your Loan. Not twice a month. We used the calculator on top the determine the results.

There is a difference between saving only a single months interest instead of seven years interest. How much to put down. We will then calculate the gross pay amount required to achieve your net paycheck.

But when you pay twice per month you might be able to decrease the amount of debt that accrues interest each month by paying. In some cases a surviving heir can cover the reverse mortgage payment by taking a new loan on the house to pay off the mortgage. Payments are made every two weeks not just twice a month which results in an extra mortgage payment each year.

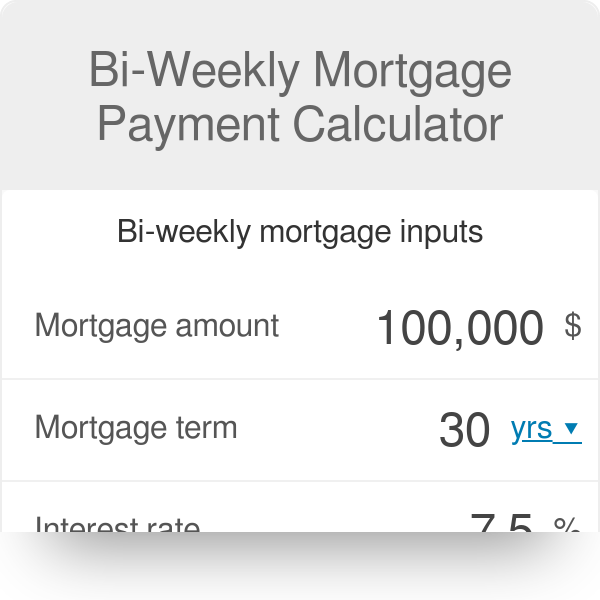

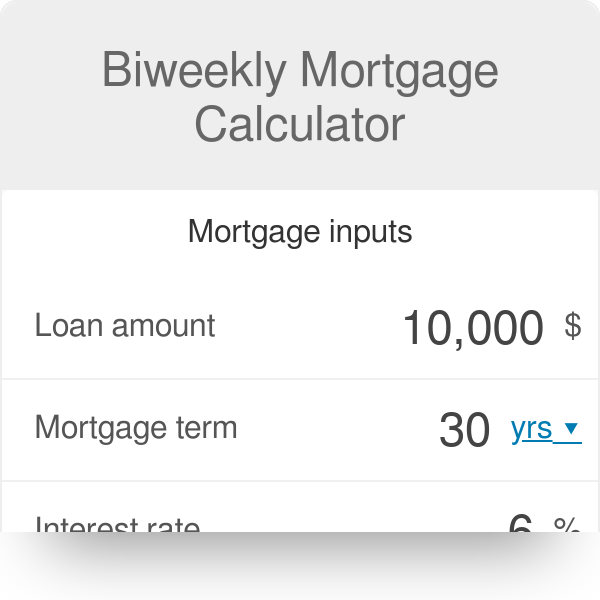

Certain months in the calendar have 30 or 31 days while the month of February only has 28 days. One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. Bi-weekly Mortgage Payment Calculator.

Home Loan Amount. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Penalties include applying repayments based on an income equal to twice the UK average earnings and even in the most extreme cases demanding you repay the total loan in one go.

A bi-monthly mortgage does not have the same results as a bi-weekly one because the homeowner pays half of the monthly mortgage twice instead of every two weeks. Private Student Loans. There is no best day of the month to pay your mortgage.

Before doing anything else use the above extra mortgage payment calculator and see how much you may save in the long run. Say your mortgage is 2000 per month. Try to avoid PMI private mortgage insurance if you can.

Instead of paying one monthly payment they pay half the payment twice a month. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments. Mortgage calculator is a simple tool that helps you estimate the cost of your mortgage.

Get the latest financial news headlines and analysis from CBS MoneyWatch. The amount you pay each month for your mortgage homeowners insurance and HOA fees. The loan is secured on the borrowers property through a process.

Read More. That leaves plenty of room in your budget to achieve other goals like saving for retirement or putting money aside for your kids college fund. 52 paychecks per year Every other week 26 paychecks per year Twice a month 24 paychecks per year Monthly 12 paychecks per year and Annually one.

Ideally you should stay long enough to reach the break-even point which is when you recoup the cost of your investment. Both the principal and interest amounts decrease over time whether you make payments on the 1st 15th or a date in between. How to buy a house with 0 down.

The chart will also. 30-Year Fixed Mortgage Principal Loan Amount. This mortgage payment calculator will help you find the cost of homeownership at todays.

A quick note here. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. With a significantly lower rate you could potentially save twice over your initial mortgage.

Extra Payment Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

How To Calculate Mortgage Payments In Excel

Bi Weekly Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Biweekly Mortgage Calculator How Much Will You Save

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Payoff

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator